Incentives for

Solar Energy

When investing into renewable energy most folks wonder if it's worth it or not. Besides the fact that you'll be diving into greener energy, there are some tax incentives for the ones that make the decision to switch to solar. On both the state and federal level, our government recognizes that you're making an investment for the future and that there should be rewards for doing so. Just because Illinois is not as sunny as Florida, doesn't mean that the incentives can't make up for those cloudy days.

Incentives in Illinois

Illinois has a RPS or a renewable portfolio standard that states as a region we must produce 25 percent of our power from renewable energy by 2025. Solar panels produce SRECs or solar renewable energy certificates, which in addition to the electricity help the state meet that renewable requirement.

It used to be that depending on the utility company, the size of your solar energy system, and how soon you invest in solar the price of each SREC would be different but non-fixed. The IPA or Illinois Power Authority would buy these SRECs typically on a quarterly basis over a five year period and would pay the property owners each time they did.

The Future Energy Jobs Act or FEJA became law June 1st 2017 and was designed to create new jobs in the renewable energy sector as well as helping us meet our RPS goal by the year 2025.

The FEJA legislation introduced a new system that replaced the old SREC program that is known as the Adjustable Block or AB Program. This system is designed to last longer than the old five year program and is now structured for fifteen years of solar energy production.

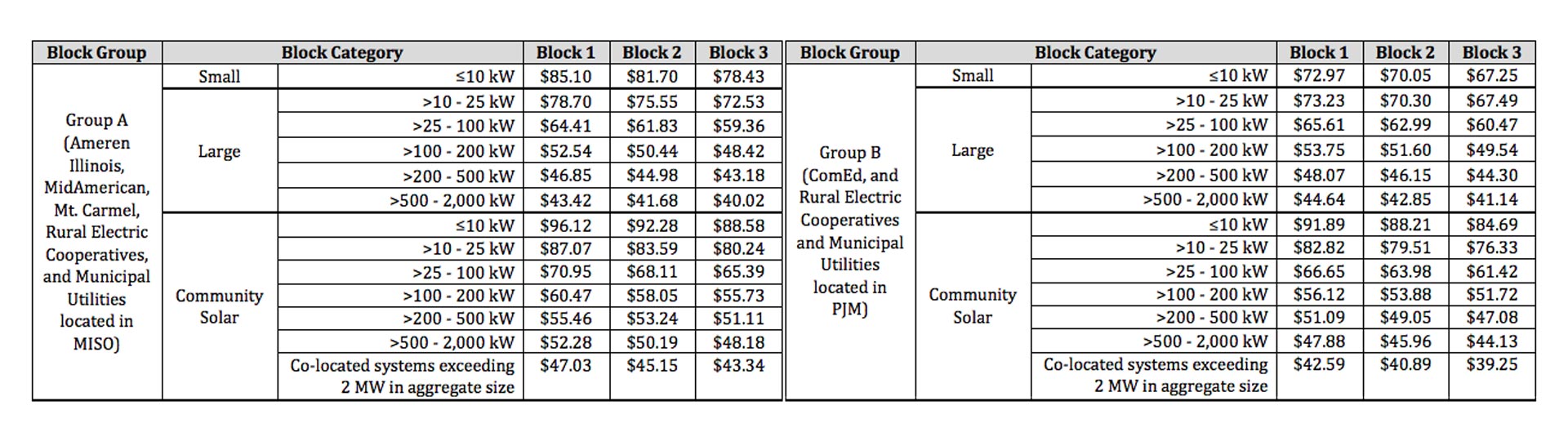

With this AB program time is of the essence, as these “blocks” are limited and as amounts are reached, the prices or incentives drop. Basically the more folks that invest in solar energy over a time period the less funds that the state will be able to give. Depending on who your energy supplier is, the type of solar you’re investing in, size of your setup, and the capacity of the blocks your SRECs will be calculated accordingly.

Below is a graphic from the Illinois Power Authority that illustrates these blocks. Here is a link to more information about the AB program

Federal Solar Tax Credits

In addition to the solar energy incentives from Illinois such as net metering and SRECs investors of this renewable energy source will be eligible for the federal solar tax credit.

This federal solar tax credit gives the solar panel owner a tax reduction on federal income taxes. The 30 percent credit applies to systems installed on or before December 31, 2019. Beginning in 2020, this incentive will begin to drop. From the initial 30 percent down to 26, then to 22 in 2021 and after 2021 this credit will end.

Contact Us